This is a collaborative piece written by:

Roy Bejarano, Co-Founder & CEO of Scale Physician Group

Jason Schifman, Co-Founder & President of Scale Physician Group

Laurence Coman, Columbia Business School ’20 MBA Candidate and Intern at Scale Physician Group

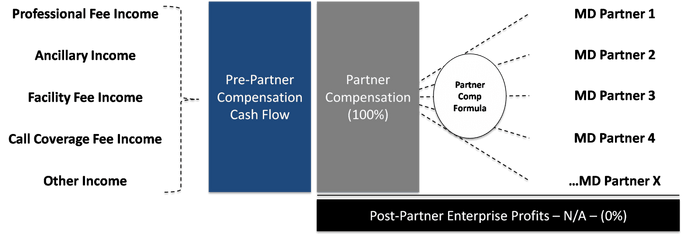

If you ask an independent physician platform how much they distribute to physician partners annually, most will be able to supply a specific answer fairly quickly. If, however, you ask “what is your post provider compensation profit?” many will struggle to offer clarity.

The conversation around physician compensation typically focuses on a narrow goal of incentivizing individual physician performance. How do we allocate revenue, as well as fixed and variable expenses to fairly attribute cash flow to those physicians producing it? Select progressive physician platforms may move beyond pure financial metrics to reward or penalize physicians for quality metrics or adherence to mandated operational workflows.

Across the country, however, relatively few independent physician platforms have effectively solved for distinguishing partner physician compensation from residual enterprise profits post-physician partner compensation.

While the granular details vary from platform to platform, typical physician compensation models generally follow similar themes. Partners are treated differently than employed physicians. Some income streams may be distributed monthly and others, say, quarterly. A portion of distributions may be categorized as fixed base compensation as opposed to incremental variable bonus distributions. Expenses are bucketed into shared corporate overhead and provider or practice location specific expenses. And, some income streams may be distributed based on productivity-driven metrics whereas others may be shared evenly or accordingly to pro rata ownership.

However, at the end of the day, the same general outcome recurs – a pot of cash flow is accumulated and run through a physician compensation formula to determine a distribution amount. There is little notion of retained enterprise profits. In fact, if a “corporate” MSO entity exists, it is often intentionally structured as a breakeven expense pass-through.

TYPICAL PARTNER PHYSICIAN COMPENSATION FORMULA FLOW OF FUNDS

Why Does Defining Enterprise Profit Post-Partner Compensation Matter?

With physicians also being the owners of the provider platform, the concept of defining enterprise profit post-physician partner compensation may seem a bit academic. And, perhaps under legacy market conditions characterized by disorganized competition and preservation of the status quo, it was.

However, the current market is evolving rapidly and independent provider platforms are finding it necessary to retool their organizations to compete. Better IT / data analytics platforms. Augmented management teams. ASC and ancillary service line development. More sophisticated financial, operational and clinical oversight programs. More advanced corporate development. Marketing and brand development. Et cetera, et cetera, et cetera.

In short, we are going through a phase of investment. And, during a period of investment, understanding your enterprise’s true profit becomes critical.

The physician compensation formulas frequently deployed in today’s market do a good job of solving for incentives of the here and now. This works well when an aggregate platform’s success is purely an amalgamation of how productive each individual physician is. More individual provider productivity = aggregate platform success.

But, the decision matrix has broadened and the importance of solving for individual physician incentives needs to be balanced with also addressing the overall enterprise’s mid-and long-term strategic positioning.

SIMPLIFIED VIEW OF STAKEHOLDER OBJECTIVES

Important discussions and deliberate decisions, therefore, need to occur around what to do with true enterprise profits. Do we dividend them out to physician owners? Or do we dividend a portion, while reinvesting another portion, and perhaps, reserving a third portion for retained cash on balance sheet?

With legacy physician compensation models that do not differentiate between partner physician compensation and enterprise profits, lines are blurred. There is no effective barometer – how should I view that new head of corporate development hire…as an investment or a pay cut?

AN ALTERNATIVE PHYSICIAN COMPENSATION FORMULA

Yes, But The Conversation Is Still An Academic One – Our Physicians Won’t Care About Fancy Distinctions Between Compensation or Enterprise Profits…They Will Care About the Size of the Check They Receive

It’s a fair point. Entrenched practices and behaviors do not change instantaneously, so any change in your platform’s view of profit segmentation is unlikely to occur overnight.

However, even if you end up dividending out all of your enterprise profits initially, we believe the habit of formally differentiating between partner compensation and enterprise profits, and clearly reporting on the two categories, is a valuable exercise. If nothing else, it will help frame critical business and investment decisions as they arise.

Beyond that, reorienting the way in which your provider platform views enterprise profits will help you keep pace with the market. The proliferation of private equity transactions in the provider platform market has subtly accelerated the process of defining provider platform enterprise profits. The acquiring fund makes an assessment of assumed enterprise profit and then converts into “acquirable” provider compensation to arrive at a post-close structure that bifurcates provider compensation from residual enterprise profits. As institutionally-funded platforms become increasingly prevalent, it is reasonable to expect that the overall market norm will continue to shift toward formally distinguishing provider compensation from enterprise profits. Your peers and competitors will be making decisions based on this view of the world, so it is at least worth conscious thought about how relevant this concept is to your platform.

Physician Employment vs. Partnership Model

Similar to physician compensation formulas, discussions around physician employment versus partnership models garners a lot of attention. What is the right model? Should our platform utilize an employed physician, partnership or hybrid model for structuring enterprise-provider relationships as we scale?

We view this discussion as highly tied into the provider compensation conversation.

Let’s first start with discussion of a model that relies entirely on employed physicians. We see this frequently in the market and, frankly, it is challenging to get right. It does paint a helpful picture of one, perhaps extreme, segment of a more comprehensive enterprise-physician relationship spectrum. From there, we can have a more nuanced conversation about enterprise-provider relationships model – when do different models make sense?

Fully Employed Physician Model

At its extreme, where you have a practice based entirely on employed physicians, where provider compensation is tied to productivity and where enterprise profits have not been adequately defined and established, employed physicians actually start to look a lot like partner physicians – and the corporate entity starts to look a lot like a non-viable shell entity. We often see this dynamic with small-scale platforms relying on narrowly concentrated ownership and broad physician employment where corporate overhead and profits have not been properly priced into provider compensation formulas.

The outcome is not dissimilar from the realities of current physician partner compensation formulas previously outlined. Simply replace “partner” with “Employed MD” and you start to see the challenge that owners of these platforms face!

INCORRECTLY PRICED EMPLOYED MD MODEL

So why not just price your employed physicians correctly and solve for enterprise profits? In reality, this is easier said than done – especially for a provider platform of small- to mid-size that has not fully captured corporate overhead / ancillary income economies of scale. You are still bound by broader market competitive dynamics and we are not yet in the perfectly efficient and highly consistent healthcare market of the future. If the provider platform or hospital across the street has not yet worked out their pricing model, or if their pricing model is based on a different universe of incentives and offsets, good luck convincing your employed physician candidates to join your platform at a discount so that you can achieve sustainable enterprise profits.

Enterprise-Physician Relationship Guiding Principles

As with most endeavors, we believe the right enterprise-provider relationship is dynamic, circumstance-driven, and specific to each platform. In essence, there are merits for both employment and partnership models to be deployed.

However, as highlighted in the above discussion of an illustrative small-scale provider platform that relies solely on employed physicians, there are different risks tied to specific models. Rather than prescribe a single correct solution, we see the discussion as more conducive to arriving at a few guiding principle takeaways across a spectrum of enterprise-provider relationships.

- Define, track and report on enterprise profits regardless of your platform size or enterprise provider model. This helps frame investment discussions and decisions, as well as inform employed and, as relevant, partner provider compensation discussions.

- Transitioning to a view of the world that correlates achieving sustainable enterprise profits with achieving sustainable platform futures will require a gradual cultural adjustment for groups that have historically prioritized near-term cash distributions or that view a dollar reinvested as a dollar pay cut.

- While employed physician models can succeed, along the way to perfecting provider pricing models and achieving meaningful scale, a partner-centric model may offer additional execution cushion to “cover” for interim deficiencies. For example, asking your physicians to be patient with a long-term plan to build enterprise profits and equity value is more likely to be well-received when those providers are co-owners in the enterprise equity value versus strictly employees of the enterprise. The inherent stickiness of a well-defined partnership model also helps to insulate a platform from the costly distraction of high provider turnover while you are building.

ENTERPRISE-PROVIDER RELATIONSHIP SPECTRUM

We frequently say that as provider platforms scale, they become complex ecosystems that depend upon the performance of a broad range of underlying subsystems.

We frequently say that as provider platforms scale, they become complex ecosystems that depend upon the performance of a broad range of underlying subsystems.

Just like any other strategic initiative, defining enterprise-provider relationships, as well as physician compensation and enterprise profit formulas requires dedicated attention, structured strategic planning & analysis, and domain expertise.

As the market continues to organize and analytically-driven business intelligence increasingly drives decision-making, platforms will not only need to define their value propositions but also stand behind them. Potential strategic partners, payers, acquirers and other market stakeholders are likely to question how your platform decides on prioritizing, staging and building consensus around the investments you need to make to succeed in your five-year business plan if you are not systematically defining and measuring enterprise profits? While not having a crisp answer to address this question may not prevent a partnership or transaction from proceeding, it is likely to result in some type of discount – whether overt or subvert.

Scale Healthcare works with our provider platform partners to align target five-year plans with day-to-day realities, including infusing overarching business plan goals into your enterprises’ physician compensation program and enterprise-provider relationships. Let us work with you to solve for these compensation complexities. Contact us for more information.